Chart patterns are a crucial tool for traders, offering insights into market trends and profitable opportunities․ The most profitable chart patterns, such as head and shoulders and double tops, are detailed in PDF guides, providing traders with clear strategies to maximize their returns․

What Are Chart Patterns?

Chart patterns are visual representations of price data arranged in specific formations, helping traders predict future market movements․ They occur regularly and provide insights into potential trends, reversals, or continuations․ These patterns, such as head and shoulders or double tops, are widely studied in resources like the most profitable chart patterns PDF, which offer detailed strategies for maximizing trading returns․ By analyzing these formations, traders can make informed decisions, enhancing their ability to identify profitable opportunities and manage risks effectively․

Why Chart Patterns Are Essential for Traders

Chart patterns are indispensable for traders as they provide actionable insights into market behavior, helping identify potential trends and reversals․ These formations enable traders to anticipate price movements, improving decision-making and risk management․ By studying reliable patterns, traders can spot high-probability trade setups, enhancing their profitability․ Resources like the most profitable chart patterns PDF offer detailed strategies, making chart patterns a cornerstone of effective trading․ They empower traders to act confidently, aligning their strategies with market dynamics for consistent success․

Key Concepts in Chart Pattern Analysis

Chart pattern analysis involves identifying and classifying formations like reversal and continuation patterns․ These concepts help traders forecast market movements, aiding in profitable trading decisions and strategies․

Definition and Classification of Chart Patterns

Chart patterns are visual representations of price movements on financial charts, helping traders predict future market behavior․ They are classified into reversal and continuation patterns, with reversal patterns signaling trend changes (e․g․, head and shoulders) and continuation patterns indicating trend resumption (e․g․, triangles)․ Additionally, bilateral patterns, like wedges, suggest potential moves in either direction․ These classifications are based on their formation and market context, providing traders with actionable insights for profitable trades․

Types of Chart Patterns: Reversal and Continuation

Chart patterns are broadly categorized into reversal and continuation patterns․ Reversal patterns, such as head and shoulders or double tops, signal a potential trend reversal, offering traders opportunities to profit from changing market dynamics․ Continuation patterns, like triangles or flags, indicate a pause in the trend before it resumes․ These classifications help traders anticipate whether the market will reverse direction or continue its current trajectory, enabling informed decisions for maximizing profits․

Importance of Chart Patterns in Trading Decisions

Chart patterns are vital for making informed trading decisions, as they help identify high-probability setups and manage risk effectively․ By recognizing patterns like head and shoulders or double tops, traders can anticipate potential breakouts or reversals․ These patterns provide clear entry and exit points, enhancing profitability․ Additionally, combining chart patterns with tools like Fibonacci levels or candlestick analysis increases their reliability, making them indispensable for disciplined and successful trading strategies․

Most Profitable Reversal Chart Patterns

Reversal patterns like head and shoulders, double tops, and rounding tops signal trend reversals, offering high-profit opportunities․ These formations help traders identify shifts in market sentiment․

Head and Shoulders Pattern

The head and shoulders pattern is one of the most profitable reversal chart patterns, often signaling a trend reversal․ It consists of a peak (head) between two lower peaks (shoulders), with a neckline connecting the bases of the shoulders․ This bearish pattern indicates a potential market top, offering traders a clear signal to exit long positions or enter short positions․ Detailed in many PDF guides, the head and shoulders pattern is a favorite among traders for its reliability in signaling market tops and offering high-profit opportunities․

Double Tops and Double Bottoms

Double tops and double bottoms are highly profitable reversal chart patterns․ A double top forms when a price peaks twice at the same level before breaking down, signaling a potential downtrend․ Conversely, a double bottom forms when a price hits the same low twice before rallying, indicating a possible uptrend․ These patterns are reliable indicators of market reversals and are widely discussed in PDF guides as they offer clear entry and exit points for traders seeking high-probability trades․

Rounding Tops and Bottoms

Rounding tops and bottoms are reversal chart patterns that signal a shift in market direction․ A rounding top, often called a “saucer top,” forms as prices gradually peak and reverse, indicating a potential downtrend․ Similarly, a rounding bottom, or “saucer bottom,” forms when prices hit a low and gradually rise, signaling an uptrend․ These patterns are highly reliable and are frequently discussed in PDF guides as they provide clear visual cues for traders to identify potential reversals and execute profitable trades with confidence․

Most Profitable Continuation Chart Patterns

Continuation patterns like triangles, flags, and wedges signal trend resumption, offering profitable opportunities․ These formations, detailed in PDF guides, help traders identify strong trend continuations effectively․

Triangles (Ascending and Descending)

Ascending and descending triangles are highly profitable continuation patterns․ An ascending triangle forms with a rising lower edge and flat upper edge, signaling bullish sentiment․ A descending triangle has a falling upper edge and flat lower edge, indicating bearish sentiment․ Both patterns suggest a potential breakout in the direction of the trend․ These formations are well-documented in PDF guides, emphasizing their reliability in predicting trend continuations․ Traders often use volume analysis to confirm breakouts, making triangles a valuable tool for strategic trading decisions․

Flags and Pennants

Flags and pennants are highly profitable continuation patterns that form after a strong price movement․ A flag is a rectangle-shaped pattern, while a pennant is triangular, both indicating a brief consolidation before the trend resumes․ These patterns are well-documented in PDF guides, emphasizing their reliability in identifying potential breakouts․ Traders often wait for a breakout above or below the pattern to enter a trade, making flags and pennants a popular choice for timing entries in trending markets․ Their formation and execution are widely covered in chart pattern trading resources․

Wedges

Wedges are versatile chart patterns that can signal both continuation and reversal, depending on their orientation․ They form when price action is confined within two converging lines, creating a narrow, wedge-shaped structure․ A rising wedge often indicates a bearish reversal, while a falling wedge suggests a bullish reversal․ These patterns are highly profitable when correctly identified, as they often precede significant breakouts․ Traders use wedges to anticipate trend changes, making them a valuable tool in various trading strategies․ Detailed insights into wedge patterns are widely available in PDF guides and trading resources․

Bullish and Bearish Chart Patterns

Bullish and bearish chart patterns, such as cup and handle and double tops, are essential for identifying market trends and profitable trades, detailed in PDF guides․

Bullish Chart Patterns: Cup and Handle, Inverse Head and Shoulders

The cup and handle pattern is a reliable bullish signal, forming a “cup” shape followed by a “handle,” indicating a potential upward breakout․ The inverse head and shoulders pattern, a reversal signal, forms a “head” below two “shoulders,” signaling bullish momentum․ Both patterns are detailed in PDF guides, offering traders clear strategies to identify and profit from these formations․ These patterns are widely used due to their high profitability and are often highlighted in chart pattern trading resources․

Bearish Chart Patterns: Double Tops, Head and Shoulders

Bearish chart patterns, such as double tops and head and shoulders, signal potential downward trends․ The double top pattern forms two peaks, indicating resistance, while the head and shoulders pattern forms a “head” above two “shoulders,” signaling a reversal․ Both are highly effective for identifying bearish momentum․ These patterns are widely discussed in PDF guides, offering detailed insights into their formation and trading strategies․ Traders rely on these patterns for their clarity and profitability in forecasting market declines․

Bilateral Chart Patterns

Bilateral patterns indicate potential price movement in either direction, offering flexibility․ They can form bullish or bearish signals, making them versatile for traders․ These patterns are detailed in PDF guides for comprehensive understanding and profitable trading strategies․

Understanding Bilateral Patterns

Bilateral patterns suggest potential price movement in either direction, offering flexibility for traders․ These formations can signal either bullish or bearish outcomes, depending on the context․

They are versatile and often indicate indecision in the market, making them valuable for identifying potential breakouts․

Resources like PDF guides provide detailed insights into these patterns, helping traders recognize and interpret them effectively․

By studying bilateral patterns, traders can enhance their ability to anticipate market shifts and make informed decisions․

Profitable Trading with Bilateral Patterns

Bilateral patterns offer traders opportunities to profit by identifying potential breakouts in either direction․ These patterns, such as head and shoulders or double tops, signal market indecision, allowing traders to prepare for upside or downside moves․

By analyzing these formations, traders can set strategic entry and exit points, maximizing profitability;

Resources like PDF guides provide detailed strategies for trading bilateral patterns effectively, helping traders capitalize on market volatility and achieve consistent results․

How to Identify High-Probability Chart Patterns

Identify high-probability chart patterns by confirming with Fibonacci levels and candlesticks, ensuring the pattern forms at the right trend location and is relatively large in size․

Key Characteristics of Reliable Patterns

Reliable chart patterns must meet specific criteria: they should form at the right trend location, have a size larger than surrounding candlesticks, and be confirmed by Fibonacci levels or candlestick signals․ Patterns like head and shoulders or double tops are considered high-probability when they align with these characteristics․ Traders should also look for clear entry and exit points and ensure the pattern reflects the market’s underlying momentum․ These traits help distinguish profitable opportunities from less reliable setups, making them essential for successful trading strategies․

Using Fibonacci Levels and Candlesticks for Confirmation

Fibonacci levels and candlestick patterns are powerful tools for confirming chart patterns․ Fibonacci retracement levels help identify potential support or resistance zones, while candlesticks provide insight into market sentiment․ For example, a bullish engulfing candlestick near a Fibonacci level can confirm a reversal pattern’s strength․ Combining these tools enhances the reliability of pattern analysis, allowing traders to make more informed decisions․ This synergy improves the accuracy of identifying profitable trades and managing risk effectively in various market conditions․

Chart Patterns in Trading Strategies

Chart patterns enhance trading strategies by identifying profitable opportunities and managing risk․ They help traders recognize trends, reversals, and continuations, enabling informed decisions across various markets․

Profitable Entry and Exit Points

Chart patterns help traders identify profitable entry and exit points by signaling potential trend reversals or continuations․ Patterns like triangles and wedges indicate breakout levels, while flags and pennants suggest continuation․ Using Fibonacci levels and candlestick confirmations enhances accuracy․ Traders can set stop-loss orders at pattern boundaries to manage risk․ These strategies work across various markets and timeframes, making them versatile tools for consistent profitability․ PDF guides detail these techniques, offering step-by-step instructions for mastering entry and exit strategies effectively․

Combining Chart Patterns with Other Trading Tools

Combining chart patterns with other trading tools enhances accuracy and profitability․ Fibonacci levels and candlestick patterns provide confirmation, while support/resistance levels refine entry/exit points․ Risk management tools, such as stop-loss orders, can be placed at pattern boundaries․ Integrating these elements creates a robust strategy, improving decision-making․ PDF guides detail how to merge these tools effectively, offering practical examples for traders to maximize their returns and minimize risks in various market conditions․

Profitability of Chart Patterns

Chart patterns have proven to be highly profitable when applied correctly․ They help traders identify trends, reversals, and continuations, maximizing returns in various markets like stocks, commodities, and forex․

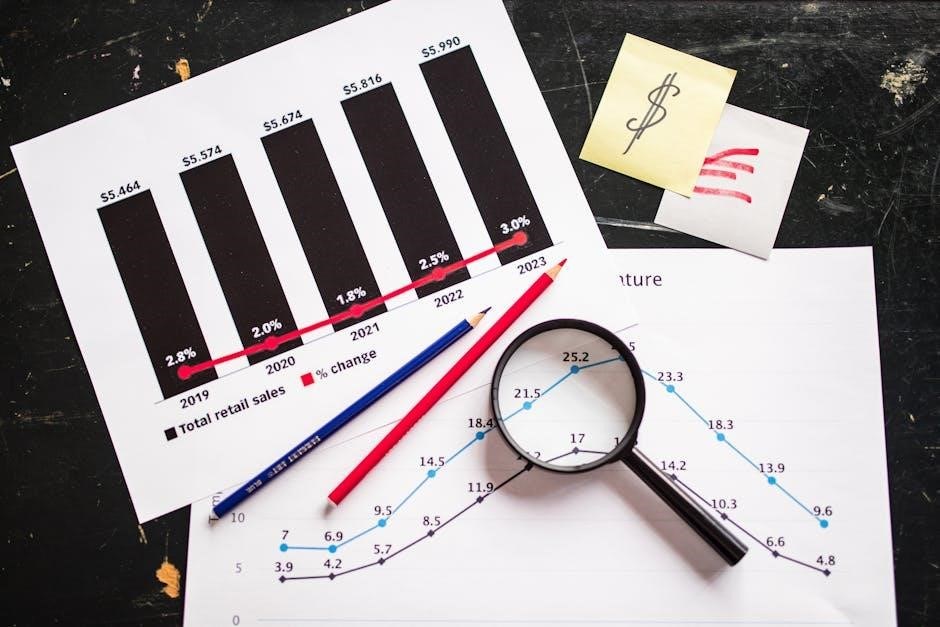

Historical Performance of Chart Patterns

Chart patterns have demonstrated consistent profitability over time, with reliable formations like head and shoulders and double tops showing high success rates․ These patterns, detailed in PDF guides, have historically predicted market reversals and continuations with accuracy․ Traders often rely on these time-tested strategies to identify profitable opportunities․ The effectiveness of chart patterns is supported by decades of market data, making them a cornerstone of technical analysis․ Their historical performance underscores their value in forecasting price movements and optimizing trading decisions․

Case Studies of Successful Trades

Real-world examples highlight the effectiveness of chart patterns in profitable trades․ For instance, the head and shoulders pattern has been successfully used to predict market reversals, while flag formations have signaled continuation of trends․ Traders using these patterns often combine them with tools like Fibonacci levels to confirm entries and exits․ Historical case studies demonstrate how these strategies have generated significant returns․ Such examples provide practical insights, helping traders refine their skills and apply chart patterns effectively in various market conditions․

Resources for Learning Chart Patterns

Discover valuable resources like PDF guides, books, and online courses to master profitable chart patterns․ These materials offer detailed strategies and practical examples for traders of all levels․

Best PDF Guides for Chart Patterns

The most profitable chart patterns PDF guides offer comprehensive insights into trading strategies․ Popular guides like the “Profitable Chart Patterns Trading Guide” and “Most Profitable 7 Chart Patterns PDF (2025)” provide detailed analysis of patterns such as head and shoulders, double tops, and wedges․ These resources include practical examples, clear explanations, and tips for maximizing returns․ They are ideal for traders seeking to enhance their skills and identify high-probability trade setups across stocks, Forex, and crypto markets․ Easy to download and accessible, these PDFs are essential tools for success․

Recommended Books on Chart Pattern Trading

Several books specialize in chart pattern trading, offering in-depth strategies for traders․ Titles like “Candlesticks, Fibonacci, and Chart Pattern Trading Tools” by Robert Fischer merge Fibonacci techniques with candlestick analysis for innovative strategies․ Another notable book provides step-by-step instructions for identifying profitable patterns, ensuring consistent trading success․ These resources are invaluable for traders aiming to master chart pattern trading and maximize their profitability in various markets, including stocks, Forex, and cryptocurrencies․

Online Courses for Mastering Chart Patterns

Online courses are an excellent way to master chart patterns, offering structured learning and practical examples․ Many platforms provide detailed tutorials on identifying and trading profitable patterns, such as head and shoulders or double tops․ These courses often include expert guidance, real-world applications, and strategies to enhance trading skills․ They are ideal for traders seeking to deepen their knowledge of chart pattern trading and apply it effectively in various markets, ensuring consistent and successful outcomes․

Chart patterns are a powerful tool for traders, offering insights into profitable opportunities․ Mastering these through resources like PDF guides enhances trading strategies and success․

Final Thoughts on Chart Patterns

Chart patterns are invaluable tools for traders, offering clear insights into market behavior and potential price movements․ By mastering patterns like head and shoulders, double tops, and flags, traders can identify high-probability opportunities․ Consistency and discipline are key to leveraging these patterns effectively․ The availability of resources, such as comprehensive PDF guides, makes learning and applying these strategies more accessible․ Whether you’re a novice or an experienced trader, dedicating time to study and practice will enhance your ability to profit from chart patterns․

Encouragement to Practice and Apply Knowledge

Mastering chart patterns requires consistent practice and dedication․ Start by studying reliable resources like the most profitable chart patterns PDF, which offers detailed insights into high-probability setups․ Regularly analyze real-time charts to identify and validate patterns․ Discipline is key; stick to your strategy and avoid impulsive decisions․ Over time, this practice will refine your skills, allowing you to confidently identify profitable trades․ Embrace learning as a lifelong process, and stay committed to improving your trading prowess․